Specifically, take a look at items that can be controlled to a large degree. Another tip is to wait to make purchases until the start of a new billing cycle or to take full advantage of payment terms offered by suppliers and any creditors. Some thoughtful maneuvering here could provide the business owner with much-needed breathing and expansion room.

It enhances the relationship between top management and operating personnel since everyone has a say in the budget. However, this strategy can take time since more employees are involved in the budgeting process. Also, some lower-level managers can use this opportunity to insert some budgetary slack so that they look good during performance. The person responsible for generating a budget varies depending on an organization’s nature and its budgetary goals.

The cash budget is important because sales and purchases are often made on credit. It ensures you have enough money on hand to keep operations running and pay bills. A production budget details the number of products you’ll need to manufacture to meet your sales forecast for the budgeted period while considering operational constraints. To create your sales budget, look at your previous fiscal year’s growth trends and ask major customers about their purchase plans for the year. You can also use sales forecasting tools that analyze past and present data and trends to predict future sales accurately.

How to create a business budget

Once you’ve got a handle on your income, it’s time to get a handle of your costs—starting with fixed costs. With a dependable business budget in hand, you’ll be more likely to make insightful spending decisions. It will also serve as a barrier that helps you to steer clear of risky expenses and objectively analyse every business expense you make.

Instead, reach out to networking friends and fellow business owners that might be willing to help. It’s always best to estimate expenses on the high-end since there are some unknowns with a startup. Without a physical product, your estimations will be based on the amount of workflow and projected hours of consultative services. Focus your income estimation on sales projections and consultant costs.

Step 5: Estimate Administrative Costs

Included on this page, you’ll find many useful small business budget templates, including a simple small business budget template and a business budget template. Plus, discover why you need a small business budget template, and how to create a small business budget template. Depending on the nature of your organization, this can be a simple or complicated process. First, a budget typically offers more granular details about how money is spent than a cash flow statement does.

Tide Cards may be issued by both Tide and PPS, who are licensed by Mastercard International for the issuance of cards. The issuer of your Tide card will be identified on your monthly card statement. Of course, you may also face unexpected and unpredictable events as well, which is where your emergency fund comes in handy (more details in the next section).

Let’s discuss five critical mistakes that small business owners make that are costing them thousands of dollars:

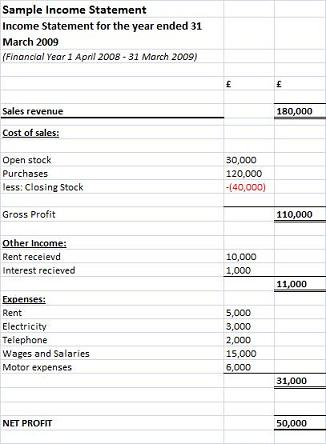

The tables and graphs on this tab offer a visual representation of your income and expenses, making it easy to see where you stand at a glance. Rather than one bloated Excel workbook that tries to do everything, PDFConverter.com has compiled a library of 15 small-business budget templates. To help you through the process, Capterra has included a detailed Instructions tab, which walks you through how to use the template step by step. As a bonus, there are several resources linked on the Instructions tab to help you create the perfect budget for your small business.

It includes tracking expenses, revenue and how much cash a business has on hand. Creating a business budget will make operating your business easier and more efficient. A business budget can also help ensure you’re spending money in the right places and at the right time to stay out of debt. For example, if you realize you’re in the red and spending more than you earn, you might cut your spending and focus on finding new clients. Alternatively, if your income is significantly higher than your expenses, you might consider investing your profits back into your business (like investing in new software or equipment).

Accounts

Ask your network what you can expect to pay for professional fees, benefits, and equipment. Set aside a portion of your budget for advisors—accountants, lawyers, that kind of thing. A few thousand dollars upfront could save you thousands more in legal fees How to create a business budget and inefficiencies later on. A budget calculator can help you see exactly where you stand when it comes to your business budget planning. It might sound obvious, but getting all the numbers in your budget in one easy-to-read summary is really helpful.

These expenses are commonly referred to as “discretionary expenses.” These are not necessary for your business to operate. Include these in your budget spreadsheet because you may choose to add them to your spending during more profitable months. Although you might be tempted to spend surplus income on variable expenses, it’s smart to establish an emergency fund instead, if possible. That way, you’ll be ready when equipment breaks down and needs replacing, or if you have to quickly replace inventory that’s damaged unexpectedly. The longer you’ve been in business, the more data you’ll have to inform your forward-looking budget. If you run a startup, however, you’ll want to do extensive research into typical costs for businesses in your industry, so that you have working estimates for revenue and expenses.

- The steps below can be followed whether creating a budget for a project, initiative, department, or entire organization.

- Of course, you may also face unexpected and unpredictable events as well, which is where your emergency fund comes in handy (more details in the next section).

- During the busy season, businesses will need to account for increased costs such as inventory, staffing, and marketing.

- This will help you make sure that your business is on track and that your spending goals are still realistic and it will also allow you to adjust throughout the year as necessary.

- “Small businesses should absolutely be sure to pad their budget with contingency funds for unseen expenses,” suggests Light.

The content is provided ‘as is’ and without warranties, either expressed or implied. Wealth Factory does not promise or guarantee any income or particular result from your use of the information contained herein. Under no circumstances will Wealth Factory be liable for any loss or damage caused by your reliance on the information contained herein. It is your responsibility to evaluate any information, opinion, advice or other content contained.

The bottom line is that small business owners need to be aware of these common mistakes to ensure they can build and grow their businesses successfully. As you work towards growing your small business, make sure you are aware of these mistakes, and avoid them at all costs. Don’t be afraid to reach out for professional help if you are caught in any of these mistakes or need guidance on optimizing the profit in your business.

Governor Josh Shapiro – pa.gov

Governor Josh Shapiro.

Posted: Wed, 16 Aug 2023 17:51:46 GMT [source]

Sometimes, managers and heads can use budgets to preempt results to their favor. This unethical practice is called budgetary slack or budget padding. Budget slacks occur when managers underestimate revenue goals and overestimate expense goals and when the business follows the participatory budget involvement strategy. The last budget that you need to prepare is the cash budget, which shows all the cash inflows and outflows from all budgets.

Budgeting for a service firm

This is especially true when your business is just starting out. Compare your projected profits to past profits to confirm whether they’re realistic. During lean months, you’ll probably want to lower your business’s variable expenses. During profitable months when there’s extra income, however, you may increase your spending on variable expenses for the long-term benefit of your business.

It also has a convenient overview sheet, which gives users access to their performance at a glance. For instance, let’s say your expenses cost $300 more than your monthly net pay. You should review your variable expenses to find ways to cut costs in the amount of $300. This may include reevaluating how much you spend on groceries, household goods, streaming subscriptions and other flexible costs.

Effective CX Strategies: Quick Steps to Business Growth – CMSWire

Effective CX Strategies: Quick Steps to Business Growth.

Posted: Mon, 21 Aug 2023 11:26:14 GMT [source]

It’s not just one budget; it’s a series of detailed budgets that together show your business’s overall production, operating, and financing plans for the budgeted period. Monthly or quarterly, compare your actual income and expense numbers to your budgeted numbers. Regular tracking helps identify financial pitfalls before they become unmanageable.